Guard EveryShilling.

Africa's First & Only FraudOps Platform

A revolutionary startup tackling the $50B+ fraud epidemic plaguing African businesses with cutting-edge AI and forensic technology — ready to deploy and protect your business today.

Stop Fraud Before It Costs You Money

Traditional fraud detection finds problems after they've already cost you money. Mlinzi detects fraud as it happens—giving you the power to prevent losses, not just discover them.

Every insight is explainable, auditable, and actionable.

- End-to-End Visibility

- Unified view across all your systems. No blind spots.

- Automation + Expertise

- AI-powered detection with human expertise. Find fraud faster.

- Explainable by Design

- Every alert explained. Complete transparency, zero black boxes.

Real-time Alerts

3 active threats detected

Proven Results Across Africa

Real organizations, real results. See how Mlinzi is transforming fraud detection across banking, insurance, manufacturing, and government sectors with measurable impact.

Measurable Results

Across all client implementations and deployments

"Finally — fraud detection that doesn't need a PhD. We reduced false positives by 80% and caught vendor collusion we'd never have spotted manually. Mlinzi paid for itself in the first month."

Ready to Transform Your Fraud Detection Capabilities?

Join industry leaders who are already seeing measurable results with Mlinzi's advanced fraud detection platform.

Real Results

Success Stories from the Field

See how organizations across different industries have transformed their fraud detection capabilities with Mlinzi.

Banking: Vendor Collusion Detection

A major Kenyan bank was losing millions to vendor collusion schemes that traditional audits missed. The bank had over 2,000 active vendors and was processing KES50M+ in monthly payments, but lacked visibility into vendor relationships and payment patterns.

Insurance: Claims Fraud Prevention

An insurance company was experiencing high claims leakage and needed better fraud detection capabilities. They were processing 5,000+ claims monthly with a 15% fraud rate, costing them KES12M annually in fraudulent payouts.

Manufacturing: Procurement Fraud

Manufacturing company suspected internal procurement fraud but lacked visibility into vendor relationships. With 500+ suppliers and KES25M annual procurement spend, they needed to identify suspicious patterns and prevent collusion between employees and vendors.

Banking: Vendor Collusion Detection

The Challenge

A major Kenyan bank was losing millions to vendor collusion schemes that traditional audits missed. The bank had over 2,000 active vendors and was processing KES50M+ in monthly payments, but lacked visibility into vendor relationships and payment patterns.

Our Solution

Deployed Mlinzi DataLake to connect procurement, vendor, and payment data across 12 different systems. Implemented real-time collusion pattern detection using advanced graph analytics and machine learning algorithms.

Results Achieved

Impact Summary

Proven Results

Real Results, Real Impact

These case studies represent just a sample of the measurable impact Mlinzi has delivered across diverse industries and use cases.

The Complete FraudOps Platform

Built for investigators, not just auditors. Everything you need to detect, investigate, and prevent fraud—from data integration to 24/7 monitoring.

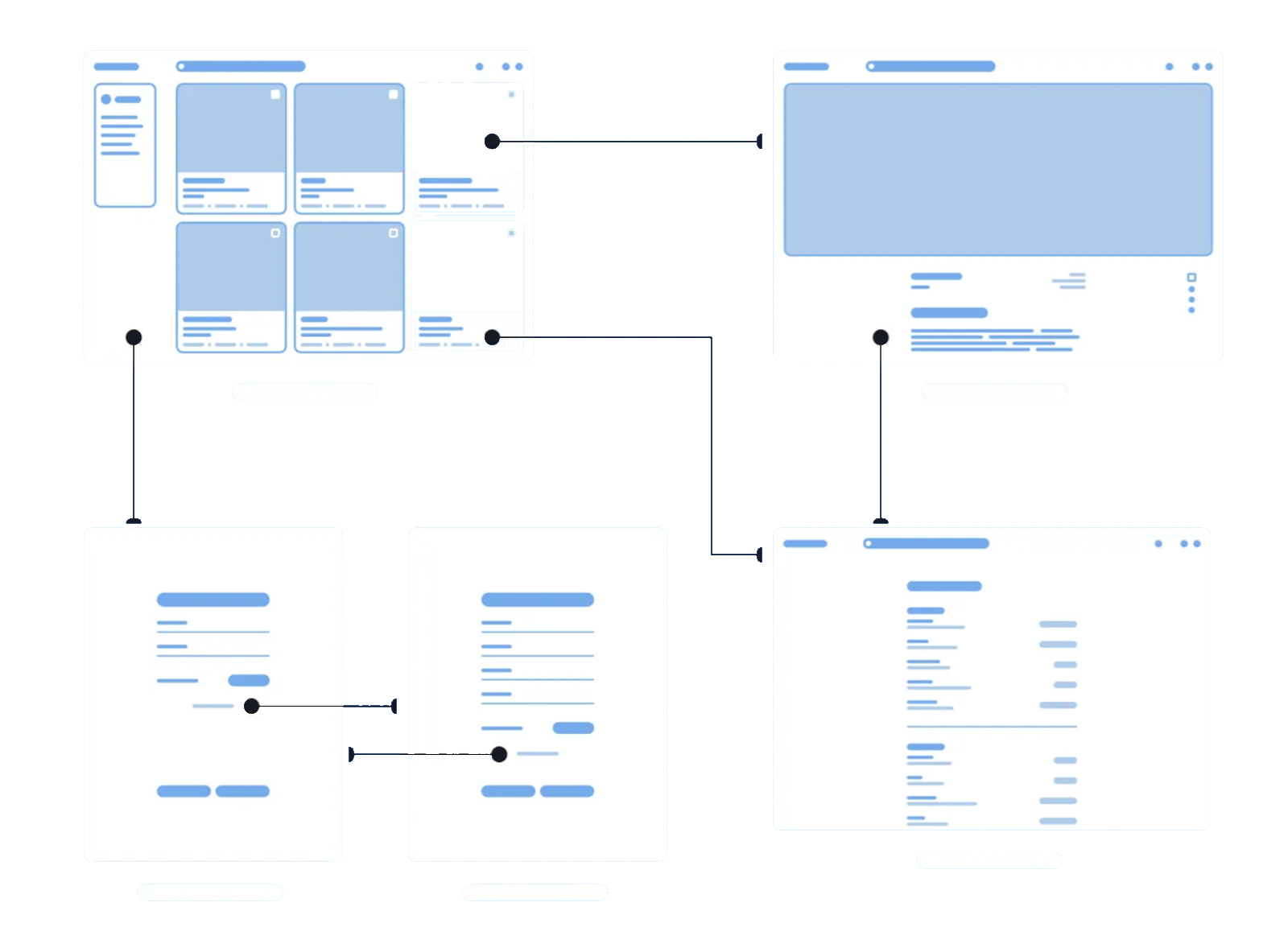

Mlinzi Fraud Studio

Visual investigation studio built on SQL & DataFrames. Drag, connect, and analyze complex fraud patterns without writing code—designed for investigators, not just analysts.

Learn moreMlinzi DataLake™

Unified data layer that connects HR, ERP, and financial systems. Transform disconnected spreadsheets into clean, normalized, analytics-ready insights in minutes.

Learn moreMlinzi SOC

Managed FraudOps Security Operations Center. Expert monitoring of transactions, controls, and exceptions 24/7—detect threats while you sleep.

Learn moreTrusted Across Industries

Discover how organizations across different sectors leverage Mlinzi's fraud detection capabilities to protect their operations.

Banking & Fintech

Financial institutions and fintech companies protecting against payment fraud, insider trading, and compliance violations.

Key Use Cases:

Telecom & Utilities

Telecommunications and utilities companies monitoring subscription fraud, billing anomalies, and infrastructure misuse.

Key Use Cases:

NGOs & Donor-Funded Projects

Non-profits and development organizations ensuring donor funds reach intended beneficiaries through transparent monitoring.

Key Use Cases:

Government & SOEs

Government agencies and state-owned enterprises maintaining public trust through transparent financial management.

Key Use Cases:

Corporate & Retail Enterprises

Large corporations and retail businesses protecting against internal fraud, supply chain risks, and financial misreporting.